In the ever-evolving world of financial trading, one principle remains constant: the importance of effective risk management. Whether you’re a seasoned trader or just beginning your journey, the ability to manage risk can make or break your success. The MetaTrader 5 (MT5) platform, one of the most popular trading platforms globally, offers a variety of tools to help traders manage their risk effectively. Among these tools, the MT5 Trailing Max Drawdown feature stands out as a vital component of any robust trading strategy.

This article delves deep into the concept of MT5 Trailing Max Drawdown, explaining what it is, why it matters, and how you can use it to enhance your trading performance. We will explore its significance in managing risk, offer practical insights on how to set it up, and discuss the strategies that can maximize its effectiveness. Whether you are trading forex, stocks, or commodities, understanding and utilizing MT5 Trailing Max Drawdown can be your key to long-term success.

Table of Contents

What is MT5 Trailing Max Drawdown?

1. Understanding Drawdown:

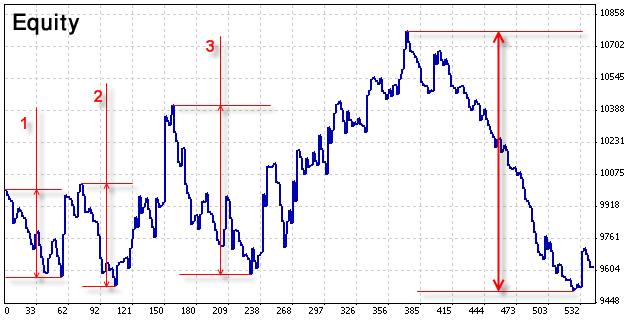

Before diving into the specifics of MT5 Trailing Max Drawdown, it’s essential to grasp the concept of drawdown. In trading, drawdown refers to the decline in the value of a trading account from its peak to its lowest point before a new high is achieved. This metric is usually expressed as a percentage and serves as a critical measure of risk and volatility.

For example, if your trading account reaches a high of $10,000 and then drops to $8,000, the drawdown is 20%. Drawdown provides insights into the potential risks associated with a trading strategy and the likelihood of recovering from losses.

Read More: Vavilaku in Tulu: Illuminating the Cultural and Spiritual Significance

2. Trailing Max Drawdown Explained:

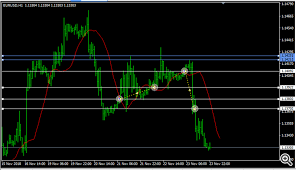

The MT5 Trailing Max Drawdown feature builds upon the basic concept of drawdown by adding a dynamic, automated component to it. Instead of setting a fixed stop-loss or accepting a static level of risk, Trailing Max Drawdown allows traders to define a maximum acceptable drawdown percentage for their positions or trading account. As the market moves, the trailing stop-loss level adjusts accordingly, reducing the maximum potential loss while locking in profits as the value of the trade increases.

This feature is particularly useful in volatile markets, where price movements can be swift and unpredictable. By automating the adjustment of stop-loss levels, traders can protect their capital more effectively and reduce the impact of emotional decision-making.

Why is MT5 Trailing Max Drawdown Significant in Trading?

1. Enhancing Risk Management:

Risk management is the cornerstone of successful trading. Without a solid risk management strategy, even the most promising trading strategies can lead to significant losses. The MT5 Trailing Max Drawdown feature is a powerful risk management tool because it allows traders to set clear, predefined limits on their losses. By automatically adjusting stop-loss levels as the market moves, this feature helps traders protect their capital and maintain a disciplined approach to trading.

2. Automating Stop-Loss Adjustments:

One of the biggest challenges in trading is knowing when to exit a trade. Emotions often get in the way, leading traders to hold onto losing positions for too long or to exit profitable trades too early. The MT5 Trailing Max Drawdown feature removes much of this emotional decision-making by automating the stop-loss adjustment process. As the market moves in favor of the trade, the stop-loss level is automatically adjusted to secure profits and limit potential losses. This automation ensures that traders stick to their risk management strategy, even in the face of market volatility.

3. Adapting to Market Conditions:

Market conditions can change rapidly, making it difficult to maintain a consistent risk management strategy. The MT5 Trailing Max Drawdown feature provides traders with the flexibility to adapt to these changing conditions. By dynamically adjusting stop-loss levels, traders can respond to market movements in real-time, ensuring that their risk management strategy remains effective even in volatile markets.

4. Improving Trading Discipline:

Discipline is essential for successful trading. Without it, traders are prone to making impulsive decisions that can lead to significant losses. The MT5 Trailing Max Drawdown feature encourages discipline by enforcing predefined risk limits and automating the stop-loss adjustment process. This helps traders stay focused on their long-term trading goals and avoid making decisions based on short-term market fluctuations.

5. Preserving Capital:

Capital preservation is a fundamental principle of trading. The MT5 Trailing Max Drawdown feature helps traders preserve their capital by limiting the maximum potential loss on any given trade. By setting a maximum drawdown percentage, traders can ensure that they do not risk more than they can afford to lose. This is particularly important for traders who are just starting out or who are trading with limited capital.

How to Set Up MT5 Trailing Max Drawdown:

Step 1: Accessing the Trailing Max Drawdown Feature:

To begin using the MT5 Trailing Max Drawdown feature, you need to access it within the MetaTrader 5 platform. Here’s how you can do it:

- Log into your MT5 account: Start by logging into your MetaTrader 5 account with your credentials.

- Navigate to the ‘Tools’ menu: Once logged in, click on the ‘Tools’ menu at the top of the screen.

- Select ‘Options’: From the drop-down menu, select ‘Options’ to open the settings window.

- Go to the ‘Trade’ tab: In the ‘Options’ window, click on the ‘Trade’ tab to access the trade-related settings.

- Set up Trailing Max Drawdown: Here, you can configure the parameters for the Trailing Max Drawdown feature, such as the maximum drawdown percentage and the trailing distance.

Read More: Stones from the Riverbed Clintasha: A Journey Through Time

Step 2: Setting the Maximum Drawdown Percentage:

The first step in configuring the MT5 Trailing Max Drawdown feature is to set the maximum drawdown percentage. This is the percentage of your account equity or position value that you are willing to risk. The optimal drawdown percentage will vary depending on your risk tolerance and trading strategy.

For conservative traders, a lower drawdown percentage (e.g., 5-10%) might be appropriate. For more aggressive traders, a higher percentage (e.g., 15-20%) may be acceptable. It’s important to strike a balance between protecting your capital and allowing your trades enough room to move.

Read More: Loans Cafe Wessel: Your Complete Guide to Financial Freedom

Step 3: Configuring the Trailing Distance:

Next, you need to set the trailing distance, which determines how closely the stop-loss follows the market price. The trailing distance is typically expressed in points or pips, and it plays a crucial role in determining how tightly your risk is managed.

- Tight Trailing Distance: A tight trailing distance will move the stop-loss closer to the market price, locking in profits quickly but potentially closing the trade prematurely if the market experiences short-term fluctuations.

- Wide Trailing Distance: A wider trailing distance gives the trade more room to breathe, reducing the risk of premature closure but also allowing for larger potential losses.

The choice of trailing distance should be based on the volatility of the market you are trading and your overall trading strategy.

Read More: Politician Lori Crossword Clue: An In-Depth Guide to Solving Political Crossword Puzzles

Step 4: Activating the Trailing Max Drawdown Feature:

Once you have configured the maximum drawdown percentage and trailing distance, you can activate the MT5 Trailing Max Drawdown feature. This can be done by selecting the ‘Activate’ option in the trade settings window. After activation, the feature will automatically monitor your trades and adjust the stop-loss levels as needed based on your settings.

Step 5: Monitoring and Adjusting Your Settings:

Even after setting up the MT5 Trailing Max Drawdown feature, it’s important to monitor your trades and adjust the settings as necessary. Market conditions can change rapidly, and what works in one scenario may not be optimal in another. Regularly review your trading performance and make adjustments to your drawdown percentage and trailing distance as needed to ensure that your risk management strategy remains effective.

Read More: Unveiling the Mysteries of bttaskcaranthirmeteor.ws in The Witcher 3: A Complete Guide

Strategies for Maximizing the Effectiveness of MT5 Trailing Max Drawdown:

1. Pairing with Other Risk Management Tools:

While the MT5 Trailing Max Drawdown feature is a powerful tool on its own, it is most effective when used in conjunction with other risk management strategies. Consider pairing it with techniques such as position sizing, diversification, and the use of fixed stop-loss levels to create a comprehensive risk management strategy.

For example, you might use position sizing to limit the amount of capital you allocate to each trade, while also setting a fixed stop-loss level to protect against sudden market reversals. The MT5 Trailing Max Drawdown feature can then be used to dynamically adjust your stop-loss as the trade progresses, further reducing your risk.

2. Testing and Optimization:

No trading strategy is perfect, and the same goes for the MT5 Trailing Max Drawdown feature. To maximize its effectiveness, it’s important to regularly test and optimize your settings. Use historical data and backtesting tools within MT5 to simulate different market scenarios and see how your drawdown settings perform.

Based on the results, you can make adjustments to your drawdown percentage and trailing distance to better suit your trading style and market conditions. Regular optimization will help you stay ahead of the market and ensure that your risk management strategy remains effective over time.

3. Adapting to Different Market Conditions:

Different markets and assets have varying levels of volatility, which can significantly impact the effectiveness of your trailing max drawdown settings. For example, trading highly volatile assets like cryptocurrencies may require a wider trailing distance to avoid premature stop-outs, while trading more stable assets like blue-chip stocks might allow for a tighter trailing distance.

It’s important to adapt your MT5 Trailing Max Drawdown settings to the specific market you are trading. Consider using different drawdown percentages and trailing distances for different assets, or even for different market conditions (e.g., trending vs. ranging markets).

4. Monitoring Performance Metrics:

In addition to monitoring your drawdown levels, it’s crucial to keep an eye on other performance metrics such as your win/loss ratio, average trade duration, and overall profitability. These metrics can provide valuable insights into the effectiveness of your trailing max drawdown settings and help you identify areas for improvement.

For example, if you notice that your win/loss ratio is declining or that your trades are being closed too quickly, it may be a sign that your trailing distance is too tight. On the other hand, if you’re experiencing large losses despite using the MT5 Trailing Max Drawdown feature, it could indicate that your drawdown percentage is set too high.

Read More: Unveiling the Social Media Sensation: t_o_princessxoxo

Common Mistakes to Avoid When Using MT5 Trailing Max Drawdown:

1. Setting the Drawdown Percentage Too High:

One of the most common mistakes traders make when using the MT5 Trailing Max Drawdown feature is setting the drawdown percentage too high. While a higher drawdown percentage allows for more flexibility in trading, it also increases the risk of significant losses. It’s important to find a balance between allowing your trades enough room to move and protecting your capital from excessive drawdowns.

2. Ignoring Market Volatility:

Another common mistake is failing to account for market volatility when setting the trailing distance. In highly volatile markets, a tight trailing distance can lead to premature stop-outs, while in less volatile markets, a wide trailing distance may expose you to unnecessary risk. Always consider the volatility of the asset you are trading when configuring your MT5 Trailing Max Drawdown settings.

3. Overcomplicating Your Strategy:

While it’s important to use a comprehensive risk management strategy, overcomplicating your approach can be counterproductive. Avoid the temptation to use too many different tools and techniques at once, as this can lead to confusion and poor decision-making. Instead, focus on a few key risk management strategies, including the MT5 Trailing Max Drawdown feature, and use them consistently to achieve your trading goals.

4. Failing to Review and Adjust Settings:

Market conditions are constantly changing, and what works today may not work tomorrow. Failing to regularly review and adjust your MT5 Trailing Max Drawdown settings can lead to suboptimal performance and increased risk. Make it a habit to regularly review your trading performance and make adjustments to your drawdown percentage and trailing distance as needed.

Read More: The Ultimate Guide to Universal Adapter Plate Fits Hella 010946281: Features, Benefits, and FAQs

Real-Life Examples of MT5 Trailing Max Drawdown in Action:

Case Study 1: Managing Risk in a Volatile Forex Market:

John, a forex trader, uses the MT5 Trailing Max Drawdown feature to manage his risk while trading currency pairs. He sets a maximum drawdown percentage of 10% and a trailing distance of 50 pips. As the market moves in his favor, the stop-loss level is automatically adjusted to lock in profits while limiting potential losses.

During a period of high volatility, John’s trailing stop-loss is triggered, closing his trade and protecting his capital from further losses. By using the MT5 Trailing Max Drawdown feature, John is able to maintain discipline and avoid making emotional decisions in a volatile market.

Case Study 2: Protecting Profits in a Trending Stock Market:

Sarah, an equity trader, uses the MT5 Trailing Max Drawdown feature to protect her profits while trading trending stocks. She sets a maximum drawdown percentage of 5% and a trailing distance of 10 points. As the stock price increases, the stop-loss level is adjusted to secure her profits.

When the market experiences a temporary pullback, Sarah’s trailing stop-loss is triggered, closing her trade and locking in her gains. By using the MT5 Trailing Max Drawdown feature, Sarah is able to protect her profits and avoid giving back her gains to the market.

Case Study 3: Balancing Risk and Reward in a Cryptocurrency Market:

Michael, a cryptocurrency trader, uses the MT5 Trailing Max Drawdown feature to balance risk and reward while trading digital assets. He sets a maximum drawdown percentage of 15% and a trailing distance of 100 points. As the market moves in his favor, the stop-loss level is adjusted to protect his profits.

Despite the high volatility of the cryptocurrency market, Michael’s trailing stop-loss helps him avoid significant losses and secure profits. By using the MT5 Trailing Max Drawdown feature, Michael is able to navigate the volatile cryptocurrency market with confidence.

Read More: Unveiling the Mysteries of Känätääj: A Deep Dive into Northern European Folklore

Frequently Asked Questions (FAQs) About MT5 Trailing Max Drawdown:

1. What is the MT5 Trailing Max Drawdown feature?

The MT5 Trailing Max Drawdown feature is a risk management tool that allows traders to set a maximum drawdown percentage for their trades or trading account. As the market moves, the trailing stop-loss level is automatically adjusted to limit potential losses and secure profits.

2. How do I set up the MT5 Trailing Max Drawdown feature?

To set up the MT5 Trailing Max Drawdown feature, log into your MetaTrader 5 account, navigate to the ‘Tools’ menu, select ‘Options,’ and go to the ‘Trade’ tab. From there, you can configure the maximum drawdown percentage and trailing distance.

3. What is the difference between a regular stop-loss and a trailing max drawdown?

A regular stop-loss is a fixed level at which a trade will be closed if the market moves against the trader. A trailing max drawdown, on the other hand, automatically adjusts the stop-loss level as the market moves in favor of the trade, reducing potential losses while locking in profits.

4. Can I use the MT5 Trailing Max Drawdown feature for different assets?

Yes, the MT5 Trailing Max Drawdown feature can be used for a variety of assets, including forex, stocks, commodities, and cryptocurrencies. It’s important to adjust the settings based on the volatility and market conditions of the specific asset you are trading.

5. How often should I review and adjust my MT5 Trailing Max Drawdown settings?

It’s recommended to regularly review and adjust your MT5 Trailing Max Drawdown settings to ensure that they remain effective. Market conditions can change rapidly, and what works today may not work tomorrow.

6. What are the risks of using the MT5 Trailing Max Drawdown feature?

While the MT5 Trailing Max Drawdown feature is a powerful risk management tool, it’s important to use it carefully. Setting the drawdown percentage too high or the trailing distance too tight can lead to significant losses or premature stop-outs.

7. Can the MT5 Trailing Max Drawdown feature help me avoid emotional decision-making?

Yes, the MT5 Trailing Max Drawdown feature helps reduce emotional decision-making by automating the stop-loss adjustment process. This ensures that traders stick to their risk management strategy and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

The MT5 Trailing Max Drawdown feature is an indispensable tool for traders seeking to manage risk effectively and maximize their trading performance. By automating the stop-loss adjustment process and providing flexibility to adapt to changing market conditions, this feature helps traders maintain discipline, protect their capital, and optimize their trading outcomes.

Whether you are trading forex, stocks, commodities, or cryptocurrencies, mastering the use of the MT5 Trailing Max Drawdown feature can significantly enhance your trading success. By setting appropriate drawdown percentages and trailing distances, regularly reviewing and adjusting your settings, and pairing the feature with other risk management tools, you can create a robust and effective trading strategy that stands the test of time.

Remember, successful trading is not just about making profits; it’s also about managing risk and preserving capital. The MT5 Trailing Max Drawdown feature offers a powerful way to achieve this balance, helping you navigate the complexities of the financial markets with confidence and control.