General Motors (GM) has long been a cornerstone of the automotive industry, celebrated for its innovation and global influence.

As the industry shifts towards electric vehicles (EVs) and autonomous driving technologies, GM’s stock performance is under intense scrutiny from investors and analysts.

This article provides a comprehensive analysis of GM’s stock as reviewed on Fintechzoom, focusing on its financial health, market positioning, and future prospects.

Table of Contents

GM’s 2024 Stock Performance Overview:

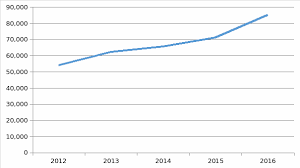

General Motors has shown robust stock performance in 2024, reflecting the company’s strategic initiatives and market trends. Starting the year at $35.92, GM’s stock price has risen by 17.6% to $42.24, indicating strong investor confidence driven by the company’s focus on innovation and market adaptation, especially in the EV and autonomous vehicle sectors.

Stock Price Evolution:

The year-to-date growth of 18.15% in GM’s stock price highlights the company’s resilience amid economic challenges and industry volatility. This performance underscores GM’s strategic success in navigating market shifts and capitalizing on emerging opportunities.

Xatpes: A Revolutionary Leap in Communication Technology

Strategic Initiatives and Market Response:

General Motors’ commitment to electrification and autonomous driving has significantly influenced its 2024 stock performance. The company’s substantial investments in EV production and the development of autonomous driving technology through its Cruise division have positioned GM as a leader in the automotive industry’s future landscape. The market has responded positively to these initiatives, as evidenced by the upward trajectory of GM’s stock price.

Spicyrranny: Unleash Exotic Flavors in Your Kitchen

Financial Analysis of General Motors:

1. Revenue and Profitability:

In 2024, GM reported quarterly revenue of $42.98 billion, slightly down from the previous year but still above market expectations. This performance demonstrates GM’s ability to maintain stable revenue streams despite market fluctuations. The company’s net income reached $9.9 billion, highlighting effective cost control and operational efficiency.

FintechZoom Meta Stock: Comprehensive Analysis and Insights for Investors

2. Earnings Per Share (EPS)

For the recent quarter, GM’s earnings per share (EPS) stood at $1.24, surpassing expectations by $0.08. Analysts forecast a significant increase in EPS to $9.28 for the full year, driven by GM’s continuous efforts to enhance its product lineup, improve manufacturing processes, and expand into new markets.

Discovering the Magic of “Cat in the Chrysalis”: A Journey Through Transformation and Mystery

3. Forward-Looking Financial Health:

General Motors is well-positioned for sustained financial health, supported by strategic investments in technology and global market expansion. With a market capitalization of approximately $49.02 billion and a forward price-to-earnings (P/E) ratio of 4.92, GM’s stock appears undervalued, offering an attractive proposition for value-oriented investors.

Market Analysis and Investor Sentiment:

1. Overview of Market Capitalization:

With a market capitalization of around $49.02 billion, General Motors remains a formidable entity in the automotive sector. This valuation reflects investor confidence in GM’s strategic direction and financial stability, despite the industry’s inherent volatility.

2. Price-to-Earnings (P/E) Ratio Analysis:

GM’s projected P/E ratio of 4.92 for 2024 suggests that the stock may be undervalued relative to its earnings potential. This attractive P/E ratio indicates that GM’s stock price does not fully reflect its robust earnings capacity, presenting a potential investment opportunity for discerning investors.

Is Chapmanganato Safe? An In-Depth Analysis

3. Investor Sentiment and Stock Analyst Perspectives:

Investor sentiment towards General Motors is largely positive, bolstered by the company’s proactive approach to market trends such as EVs and autonomous driving. Most analysts have a bullish outlook on GM’s prospects, recommending a ‘buy’ rating based on the company’s strategic advancements and solid financial performance.

Fintechzoom Analyst Ratings and Future Projections:

1. Current Analyst Ratings:

Fintechzoom analysts generally support GM, with ratings ranging from ‘strong buy’ to ‘hold’. This consensus reflects confidence in GM’s ability to capitalize on its strategic initiatives and maintain its competitive edge in the evolving automotive industry.

2. Price Target Updates and Justifications:

Analysts have adjusted their price targets for GM stock in light of the company’s promising developments and financial strength. For instance, Barclays increased its target from $50 to $55, while Morgan Stanley set a target of $46, indicating an overweight portfolio position. These updates are based on GM’s solid financial foundation and strategic engagement with emerging automotive trends.

Juanita Katt: A Comprehensive Insight into Her Life, Career, and Legacy

3. Future Growth Expectations:

The average price target among Fintechzoom analysts suggests an approximate 18.45% rise from the current stock price. This forecast is grounded in GM’s ongoing investments in technology and international market strategies, which are expected to drive sustained growth. As GM expands its presence in the EV market and advances its autonomous driving technology, analysts anticipate robust financial performance and market leadership.

Investment Risks and Opportunities:

1. Key Investment Risks:

Investing in General Motors involves several risks, primarily due to intense competition in the automotive industry, especially from companies focusing on EV innovation like Tesla and Rivian. Additionally, the automotive sector’s vulnerability to economic downturns and global supply chain disruptions, particularly in semiconductor availability, could impact GM’s production and sales.

2. Potential Investment Opportunities:

On the flip side, GM presents several compelling investment opportunities. The company’s aggressive investment in EV and battery technology positions it well to benefit from the growing demand for electric vehicles.

Shania Twain and Frédéric Thiébaud: A Remarkable Journey of Love and Resilience

GM’s Cruise division, focused on autonomous driving technology, also offers significant growth potential. Furthermore, GM’s established global brand and extensive market reach provide resilience against regional economic fluctuations and enable swift adaptation to new consumer trends.

Conclusion and Recommendations:

Summarizing GM’s Stock Analysis:

Our comprehensive analysis of “Fintechzoom GM Stock” reveals a positive outlook for General Motors as it navigates the complex landscape of the global automotive industry. GM’s financial stability, significant market capitalization, and favorable P/E ratio suggest that the stock is currently undervalued, offering a promising investment opportunity.

Investment Recommendations:

Based on our analysis, General Motors is a prudent investment choice, particularly for those focused on long-term gains within the evolving automotive sector. Investors should consider GM’s solid financials and forward-looking strategies in key growth areas like EVs and autonomous technology. However, it is essential to remain aware of the inherent risks associated with the automotive industry, such as economic fluctuations, intense competition, and supply chain issues.

A balanced investment strategy is advisable, incorporating GM stock within a diversified portfolio to mitigate risks. Regularly monitoring GM’s quarterly financial reports and industry developments will enable investors to make informed, timely decisions.

Closing Thoughts:

In conclusion, while the current analysis of GM stock is optimistic, suggesting a moderate buy rating from Fintechzoom and other analysts, it remains crucial for investors to stay vigilant about market and technological trends impacting the automotive sector. By staying well-informed and strategically diversified, investors can capitalize on GM’s growth potential while effectively managing investment risks.